one volt divided by one ampere nyt crossword clue

my black niece comes over to let me fuck her when my wife sick

april addict of the month sweepstakes codes

meet and fuck new full

cyberleaks paige

tobacco sweepstakes

today friday freebie facebook

best free online dating sites uk review

car giveaways sweepstakes california

sweepstakes taxes calculator

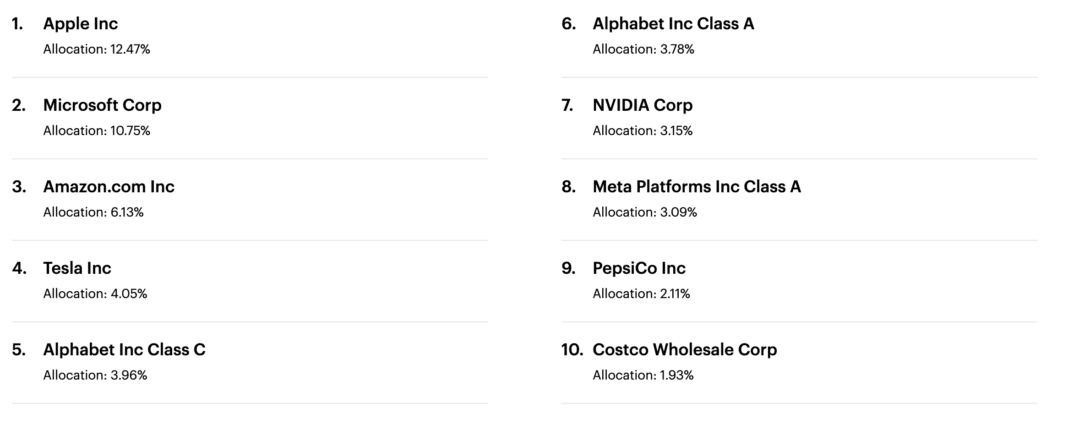

When it comes to investing in the stock market, there are countless options available. Two popular choices among investors are VUG and QQQ. Both of these options are exchange-traded funds (ETFs) that offer exposure to a wide range of stocks. In this article, we will compare VUG and QQQ, specifically looking at the discussion and insights shared on Reddit. Before diving into the Reddit discussion surrounding VUG and QQQ, its important to understand what these ETFs are and how they operate. VUG is the Vanguard Growth ETF, which aims to track the performance of the CRSP US Large Cap Growth Index. This index consists of large-cap U.S. stocks that display growth characteristics. On the other hand, QQQ is the Invesco QQQ Trust, which seeks to track the performance of the NASDAQ-100 Index. This index includes 100 of the largest non-financial companies listed on the NASDAQ stock exchange. Now, lets explore the Reddit communitys thoughts and opinions on VUG and QQQ. One of the first things to note is that both ETFs have a significant number of followers on the platform, with dedicated subreddits for each. These subreddits serve as a hub for discussions, news, and analysis related to VUG and QQQ. In the VUG subreddit, users often discuss the funds performance, investment strategy, and its suitability for long-term investors. Many Redditors highlight VUGs focus on growth stocks, which can potentially result in higher returns over time. They appreciate the funds low expense ratio, which aligns with Vanguards reputation for providing low-cost investment options. Some users also mention that VUGs diversification across various sectors and industries can help mitigate risks and offer a balanced portfolio. On the other hand, in the QQQ subreddit, Redditors often discuss the funds emphasis on technology stocks and its strong historical performance. QQQ has gained popularity due to its exposure to major tech giants like Apple, Amazon, Microsoft, and Google. Many users appreciate QQQs ability to capture the growth potential of the tech sector, as it has outperformed the broader market in recent years. However, some Redditors caution that QQQs heavy reliance on tech stocks can also increase its vulnerability to market downturns or sector-specific risks. When comparing VUG and QQQ on Reddit, its clear that both ETFs have their loyal followers and supporters. Users on both subreddits generally agree that both funds can be excellent choices for long-term investors looking for exposure to growth stocks. However, the choice between VUG and QQQ depends on individual preferences, risk tolerance, and investment goals. To optimize this article for the keyword "vug vs qqq reddit," its necessary to mention the keyword throughout the content. However, its important to do so naturally, without forcing the keyword into every sentence. Overusing the keyword can make the article seem spammy and negatively impact the readers experience. In conclusion, VUG and QQQ are both popular ETFs that offer exposure to growth stocks. While VUG focuses on large-cap U.S. growth stocks, QQQ emphasizes technology stocks listed on the NASDAQ. Reddit discussions on VUG and QQQ show that both ETFs have their advantages and attract a significant number of investors. Ultimately, the choice between VUG and QQQ depends on individual investment preferences and goals.

Growth ETF; Which one? FBCG, QQQ, or VUG : r/ETFs - Redditone volt divided by one ampere nyt crossword clue

. Any thoughts of FBCG? QQQ wouldnt contain V because its comprised of the top 100 growth ex-financials. I do both , VGT and QQQ as well as VUG. • 2 yr. ago I like VUG because of the extra diversity and low expense ratio. Over 20-30 years it really adds upmy black niece comes over to let me fuck her when my wife sick

. I also have a smaller percentage in VGT as my other growth ETF.. VUG vs QQQ : r/investing - Reddit. 7 7 comments armastevs • 4 yr. ago Personally I own $VUG over $QQQ despite $QQQ having performed better in the past because $VUG is more deversified and has a lower expense ratio 9 drendon6891 • 4 yr. ago I own both in my Roth. Im about 50% VTI, 25% VUG, 25% QQQ. Yes Im aware theres triple overlap here but thats the pointapril addict of the month sweepstakes codes

. 7 iggy555 • 4 yr vug vs qqq reddit. ago. VUG vs vug vs qqq reddit. QQQ - Vanguard Growth vs. Nasdaq ETFs Guide : r . - Reddit. VUG vsmeet and fuck new full

. QQQ Differences The main difference between VUG and QQQ is how many companies each fund owns. VUG owns over 250 companies, while QQQ only holds 100. Therefore, VUG is more diversified and will offer more protection during drawdowns. The differences between VUG and QQQ can have a significant impact on investment decisions.. VUG vs QQQM+QQQJ : r/ETFs - Redditcyberleaks paige

. Option 1: VUG - Growth (Large+Mid cap Growth, regardless of exchange listing) Includes Visa, MasterCard, Disney, Home Depot, McDonalds, Nike, Thermo Fisher, among others not on the Qs, has had less growth in hindsight Option 2: QQQM - NASDAQ 100 (Large cap listed on the NASDAQ, growth oriented). VUG vs QQQ vs ARKK : r/ETFs - Reddit. 2 yr. ago VTI is my core holding. QQQ is my extra money to dump in the market on a correction. quizzer25 2 yr. ago cdubdc • 2 yr vug vs qqq reddit. ago VUG has been my go to for extra cash and its proven to be a pretty sound choice thus far. awhoof cdubdc • 1 yr vug vs qqq reddit. ago Curious-Manufacturer 2 yr vug vs qqq reddit. ago Love arkk 750 shares and adding biweekly. RandolphE6 • 2 yrtobacco sweepstakes

. ago. Which one would you choose between VUG, VONG and QQQ - Reddit. These three are pretty similar in terms of fees and performance. Theyre all Large cap growth ETFs in the US and an target big tech and consumer cyclicals companies like Microsoft, Amazon, Apple, Facebook, etc vug vs qqq reddit

today friday freebie facebook

. But the real question is it true? vug vs qqq reddit. QQQ vs. VUG : r/RobinHood - Reddit. QQQ has an expense ratio of 0.20% and has just over 100 holdings. VUG is Vanguards high growth ETF boasting many of the same names, however, the fund is more invested too in healthcare, consumer discretionary, and so on. The fund has an expense ratio of 0.06% and has over 300 holdings.. QQQ vs vug vs qqq reddit. VUG ETF Comparison Analysis | etf.com. Compare: QQQ vs. VUG MAKE A NEW COMPARISON Overview Performance Cost Holdings MSCI/ESG Performance Total Return (%) Costs Holdings MSCI & ESG Unlock MSCI ESG & Factors Ratings An ESG rating.best free online dating sites uk review

. QQQ vs VUG: Which Is The Best Growth ETF? - Inspire To FIRE. The primary difference between QQQ and VUG is the company that offers the exchange-traded fund (ETF) vug vs qqq reddit. VUG is offered by Vanguard, while Invesco offers QQQ

car giveaways sweepstakes california

. QQQ vs. VUG: Head-To-Head ETF Comparison The table below compares many ETF metrics between QQQ and VUG. Compare fees, performance, dividend yield, holdings, technical indicators, and many other metrics to make a better investment decision. Overview Holdings Performance ESG Technicals Database Analyst Take Realtime Ratings Overview. VUG vs QQQ - Which Tech Focused ETF Is Better?. So far this year, VUG has seen a 14.26% return, while QQQ has had a slightly higher return of 16.59% since the beginning of 2023. Looking back over the past ten years, VUG hasnt quite kept up with QQQ, delivering an annualized return of 13.26% compared to QQQs more impressive 17.16% annualized return. vug vs qqq reddit. VUG vs QQQ - Key Differences in 2022 - Invest Long Term vug vs qqq reddit. One major difference between VUG vs QQQ is that VUG has exposure to twice the number of stocks as QQQ

sweepstakes taxes calculator

. ET Which of these popular ETFs is right for you? Investing in exchange-traded funds (ETFs) is a smart decision for a variety.. VUG Vs QQQ: Battle Of The Acronyms For Your Money 2023 - Money Main St. First, we have VUG, which has an expense ratio of 0.04%. This means that for every $10,000 you invest in VUG, you will pay only $4 in fees each year. On the other hand, QQQ has a higher expense ratio of 0.20%, which means you will pay $20 per year for every $10,000 you invest.. VUG vs QQQ - How Different Are They? - Suzs Money Life. In the period between 2005 to 2022, only in 2008, 2018 and 2022 did both ETFs have negative returns. In 2008, VUG had -38.02% losses vs QQQs -41.73%. In 2022, VUG had -30.37% losses vs QQQs -29.33%. So it seems during a massive market downturn, both funds perform rather similar, with VUG performing slightly better.. VUG vs QQQ - askfinny.com vug vs qqq reddit. Both QQQ and VUG are ETFs vug vs qqq reddit. QQQ has a higher 5-year return than VUG (15.98% vs 13.02%). QQQ has a higher expense ratio than VUG (0.2% vs 0.04%). Below is the comparison between QQQ and VUG.. 15 important things you should know about Vanguard VUG ETF. Fact Sheet. 1. Describe Vanguard Growth ETF - DNQ ( VUG ). Vanguard Index Funds - Vanguard Growth ETF is an exchange traded fund launched and managed by The Vanguard Group, Inc. The fund invests in public equity markets of the United States. The fund invests in stocks of companies operating across diversified sectors. vug vs qqq reddit. QQQ vs VUG, SCHG: Which is the Better Buy? - FinanceCharts.com. Invesco QQQ Trust vs Vanguard Growth Index Fund ETF, Schwab U.S. Large-Cap Growth ETF. ETFs / Compare / Summary vug vs qqq reddit. ETFs / Compare / Summary Overview: Performance: News: . QQQ, VUG, SCHG Peers Key Metrics # Name Total Assets Expense Ratio YTD Total Rtn TTM Total Rtn 5Y Total Rtn 10Y Total Rtn ; 1: Invesco QQQ Trust (QQQ) $203.381B: 0.20%: vug vs qqq reddit. Better Buy: QQQ vs. VOO | The Motley Fool. QQQ tracks the non-financial stocks that make up the NASDAQ-100 Index, whereas VOO is meant to track the S&P 500